Industry Reports

Pulling Together: The Productivity and Skills Agenda

Over the past three years, Tourism HR Canada’s research team has been closely monitoring and studying the shifting dynamics of the tourism workforce as the sector continues its post-COVID recovery. This work has involved a number of parallel and concurrent research activities, including:

-Regular surveys of business operators on their business conditions

-Regular surveys of the general population on their perception of working in tourism

-Monthly and annual analyses of tourism workforce trends

-Focus groups and interviews with employers from across the sector

-Production of the Tourism Human Resource Module, with Statistics Canada

-A careful examination of the 2021 census data around tourism employment

-Projections to 2040 on labour supply and demand in the sector, with the Conference Board of Canada

-Research and workplace recommendations around workplace mental health

-Examination of policy changes around immigration programs

ONTARIO CONSUMER SURVEY

Travelling within Ontario offers residents a rich blend of natural beauty, cultural experiences, and local charm. From tranquil lakeside getaways and scenic hiking trails to vibrant cities and celebrated culinary destinations, Ontarians value low-stress, accessible escapes rooted in regional authenticity. Popular destinations like Niagara, Toronto, Muskoka, and Prince Edward County reflect diverse interests—whether it’s wine tasting, food festivals, artisanal markets, or family-friendly attractions. Seasonal travel remains strong, with summer and fall offering outdoor adventures and small-town charm, while winter and spring highlight cozy escapes and local festivals. Culinary travel is a standout, with farmers' markets, wineries, and lakeside dining creating lasting memories. With a strong preference for local trips over international travel, especially to the U.S., Ontario continues to offer meaningful, year-round experiences that reflect residents’ love for homegrown travel and hospitality.

Prepared for: Destination Ontario March 21st, 2025

US PULSE SURVEY

Recent U.S. political developments, such as the suggestion of Canada becoming the 51st state and the imposition of tariffs, have had minimal impact on Ontario’s destination and brand perception, with key metrics remaining stable. Despite these political events, Canada continues to be seen as a welcoming and safe destination, with a positive outlook for the year ahead. Travel plans have largely remained unaffected, with the majority of respondents stating their travel intentions have not changed. The primary drivers for U.S. travelers are convenience, cost, and the favorable exchange rate, with political alignment only influencing the U.S. Fly market. Potential barriers to travel include concerns about political tensions, safety, and cost, with cost being the most significant deterrent. For the U.S. Drive market, messaging should emphasize ease of travel and hassle-free border crossings, while for the U.S. Fly market, focusing on Ontario’s welcoming atmosphere and cultural vibrancy would be key. Maintaining Ontario’s image as an affordable, high-value destination is crucial for attracting visitors.

Prepared for: Destination Ontario - February 12th, 2025

The Power of Co-Op Marketing

Driving Success for You & Your Stakeholders

Travel is about making memories—whether recharging, discovering new places, or broadening horizons. Destination marketers play a crucial role in guiding travellers, but standing out in a crowded market can be challenging. Co-op marketing offers a powerful solution by pooling resources with hotels, tourism boards, and local businesses to create larger, more impactful campaigns. By leveraging collaboration, marketers can extend their reach, enhance credibility, and drive visitation more effectively.

Wealth and Wellbeing Index

Destination Canada has launched Tourism’s Wealth & Wellbeing Index, a groundbreaking tool that goes beyond traditional metrics to assess tourism’s broader benefits to Canadians. The Index highlights tourism’s role in economic growth, cultural preservation, infrastructure development, environmental stewardship, and community engagement. Comprising six key components—Economy, Employment, Enablement, Environment, Engagement, and Experience—the Index provides data-driven insights for policymakers and industry leaders. With tourism projected to outpace Canada’s broader economy, the Index serves as a strategic framework for sustainable growth, aligning with global standards like the UN’s Sustainable Development Goals. The inaugural report presents key findings, including tourism’s role in GDP expansion, infrastructure enhancement, business diversity, and strong public support. Available through the Canadian Tourism Data Collective, future iterations will offer deeper regional insights to guide investment and policy decisions.

Skift Mega Trends - Looking Ahead to 2025

The Skift Mega Trends for 2025 highlight a transformative period in travel, where trends like deliberate and soulful travel gain momentum, and backyard tourism rises in popularity as global exploration slowly recovers. Hotels are poised for growth, rewarding those who persevered through tough times, while lifestyle brands innovate to meet the evolving demands of travellers. The shift to remote work is reshaping business travel, and Asia is growing while reflecting inward. Meanwhile, travel sector boundaries are becoming less defined, with new models like subscriptions gaining traction. With flexibility and agility, brands will thrive, and automation is on the rise—particularly in payments and operations. The report also emphasizes how the travel industry is responding to challenges, including airlines backing away from risky ventures, cruise lines focusing on private islands, and short-term rentals adjusting to new headwinds.

Sojern - State of Destination Marketing 2025

This report explores the evolving landscape of destination marketing, highlighting how Destination Marketing Organizations (DMOs) are transforming their approaches to better engage travellers while supporting local communities. As digital strategies advance, DMOs are leveraging programmatic advertising, social media, and AI tools to address challenges such as tight budgets and changing traveler behaviors. With a focus on data, aligning KPIs with broader goals, and embracing new technologies, DMOs are finding innovative ways to thrive. The report concludes by looking ahead to the future of destination marketing, emphasizing the importance of reimagining possibilities and creating lasting impact for both travellers and local communities. Insights from nearly 200 global DMO leaders inform these key trends and actionable strategies.

BUILDING A DATA-DRIVEN DECISION-MAKING CULTURE WITHIN ONTARIO’S TOURISM INDUSTRY - RTO Multi-Year Research Program

RTO 9: Quarterly Insights Report Edition 2 of 6

In the first nine months of 2024, Ontario’s tourism sector demonstrated resilience, with spending reaching $29.1 billion—a 4.8% increase from 2023. Domestic tourism surged by 9%, outpacing inflation, while international spending declined by 2.2%, emphasizing the province's reliance on local travellers amidst global uncertainties. Food and beverage spending led the way, accounting for 33% of total expenditures, while recreation and entertainment stagnated, signalling a need for innovation. The U.S. market remains critical, contributing 22% of spending, though emerging international markets like China, India, and Brazil show potential. RTO 9 recorded $1.8 billion in spending, with domestic growth at 11% and international growth at 15%, supported by effective marketing efforts. However, a September slowdown and challenges in the accommodation sector highlight the need for targeted strategies to sustain year-round tourism, particularly during the winter months. Culinary tourism and regional travel preferences present strong opportunities for growth.

BUILDING A DATA-DRIVEN DECISION-MAKING CULTURE WITHIN ONTARIO’S TOURISM INDUSTRY - RTO Multi-Year Research Program

RTO 9: Quarterly Insights Report Edition 1 of 6

In 2024, Ontario’s tourism sector continues its resilient post-pandemic recovery, with $16.1 billion in spending during the first half of the year, marking a 3.1% increase from 2023. However, challenges such as inflationary pressures, shifting visitor spending behaviours, and persistent seasonal imbalances—especially in winter—remain significant. Domestic tourism has proven critical, contributing 53% of total spending, while summer tourism thrives with strong engagement from local and international markets, particularly China and India. Border crossings and U.S. visitation lag behind pre-pandemic levels, though emerging markets like Brazil show promise. Workforce recovery is notable, with over 700,000 employed and a projected growth rate of 7% through 2025, though labour shortages in transportation and accommodation sectors persist. Strategic efforts in marketing, workforce development, and enhancing year-round offerings, particularly in culinary and entertainment tourism, are essential for ensuring sustainable economic growth and addressing evolving traveller demands.

Traveller Segmentation Program

Discover what motivates, inspires, and drives travellers with the Traveller Segmentation Program, a powerful tool designed to empower and unite Canada's tourism industry. By unlocking deeper insights into visitor behaviours and preferences, this program enables more meaningful, targeted, and impactful marketing and destination management strategies.

Destination Canada - A Regenerative Approach to Tourism in Canada

Around the world, including in Canada, there is a growing demand for tourism that prioritizes communities and the environment, often referred to as “regenerative tourism.” These calls come from communities, travellers, and the tourism sector itself, with Destination Canada championing this approach in its strategy documents and supporting this report. To advance regenerative tourism effectively, it is vital to understand why this shift is necessary, what being regenerative means, and how it can be practised within tourism.

Drawing on decades of experience, global research, and emerging insights, this document provides a foundational framework for regenerative tourism, complemented by inspiring real-life examples. It emphasizes three core elements: fostering meaningful connections between people and place, developing experiences enriched by local narratives and care, and building capacity for resilience and flourishing across communities, businesses, and ecosystems. These practices aim to rejuvenate communities, enterprises, and the environment, while offering an invitation to engage at local, regional, and national levels.

The DMO’s Guide to Creator Content: Unlock the Power of Content Creators

What's inside:

1. Finding a Creator

2. Choosing the Right Content Creator

3. Briefing Creators

4. Creator Management

5. Put it to Work!

Tourism SkillsNet Ontario: Workforce Issues, Opportunities and Impact

Tourism is an economic driver, a job creator, and a vehicle for fostering social cohesion. It employs 9.3% of the workforce and provides valuable work experience for 50% of Canadians. It promotes Indigenous heritage and culture, while supporting environmental protection and sustainable livelihoods in every corner of the province.

In Ontario, tourism revenues are forecasted to continue to grow from $86 billion in 2024 to over $101 billion in 2027. At the same time, employment demand is projected to expand to more than 763,000 jobs by 2027.

Addressing the labour crisis through enhanced coordination and innovativevworkforce solutions, such as those underway through Tourism SkillsNet Ontario (TSNO), remains one of the best opportunities to protect this critical sector for the future.

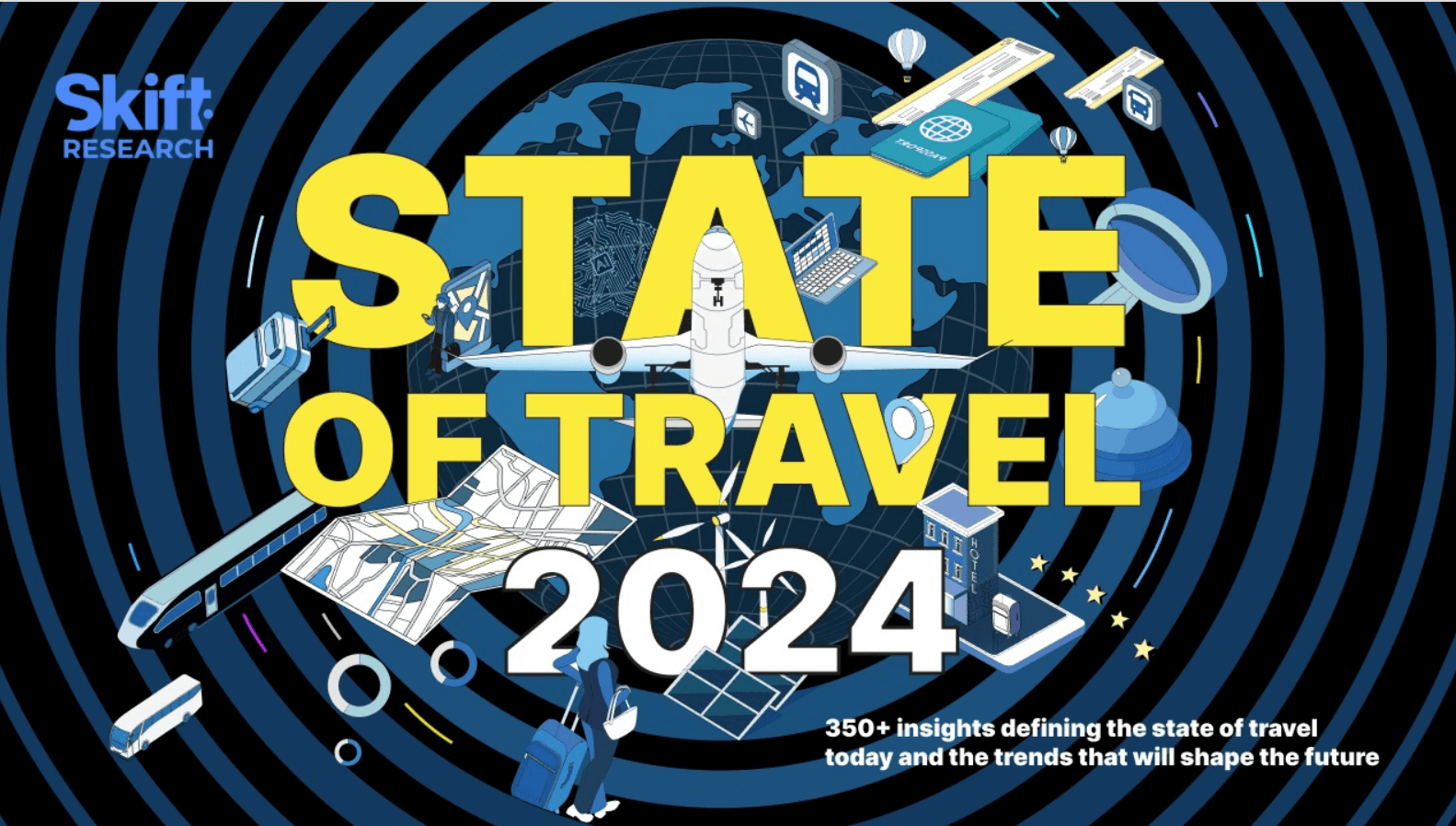

State of Travel 2024

The "State of Travel 2024" report by Skift Research marks the beginning of a new era for the travel industry, free from the direct impacts of the COVID-19 pandemic. The industry is thriving, with travel businesses experiencing healthy growth. However, the report raises critical questions about potential economic recessions, the future of Chinese travel, budget airlines, and the role of AI-powered technology.

This comprehensive report serves as a guide for navigating the travel landscape in 2024, offering over 350 insights, including consumer trends, sector analyses, and executive perspectives. It aims to help businesses and organizations identify and capitalize on emerging opportunities. The report is divided into three sections: travel performance and the economic landscape, industry trends, and a sector-by-sector overview.

DESTINATION CANADA’S 2030 TOURISM STRATEGY: A WORLD OF OPPORTUNITY

Tourism stands out as a pivotal industry in Canada, extending its positive influence across the nation's people, places, and prosperity. From bolstering local economies to fostering cultural appreciation, tourism plays a vital role in enriching communities nationwide. "A World of Opportunity," the document presented here, underscores the sector's commitment to continued positive impact and outlines a collaborative vision shaped by insights gleaned from partners and lessons learned during the pandemic. Aligned with the Federal Tourism Growth Strategy: Canada 365, this forward-thinking approach emphasizes sustainable growth and aims to unlock the sector's full economic potential, projecting up to $160 billion in annual revenue by 2030. It envisions a Canada that not only attracts global visitors but also prioritizes sustainable practices and fosters resilience for future generations. The strategy invites all stakeholders to join in shaping a resilient and prosperous future for Canadian tourism.

State of Destination Marketing 2024

The State of Destination Marketing 2024 study has gathered critical insights into the strategic decision-making of destination marketing teams. The study outlines the implications of global disruptions, such as the cost of living crisis, political instability, and technological advancements.

The report delves into destination marketing from four different perspectives:

1. Strategy & Performance

2. Media Landscape

3. Data & Insights

4. Emerging Trends

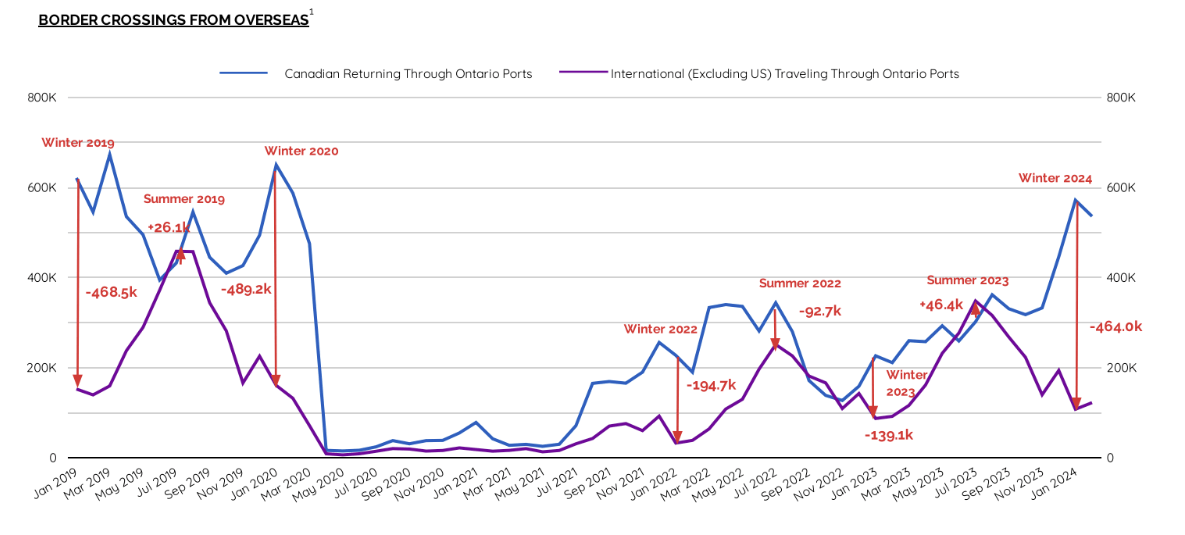

Ontario Tourism Health Check - as April 30, 2024

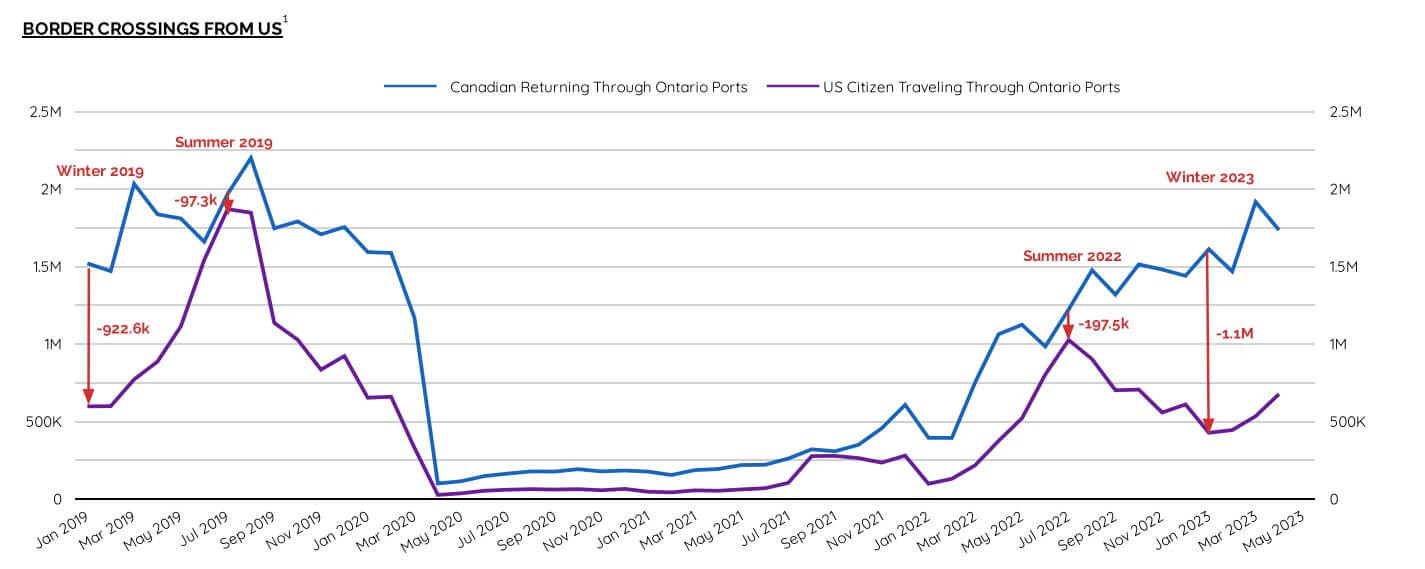

Destination Ontario’s Data & Insights team has released the most recent Ontario Tourism Health Check report highlighting recovery indicators such as accommodation occupancy rates and border crossings. As a reminder, this report tells the tourism recovery story by curating relevant tourism data into a format that visualizes the information for industry stakeholders. The report is based on open-data and is shareable with the Ontario tourism industry.

Fall 2023 Tourism Outlook

Given the ongoing evolution of factors impacting travel, Destination Canada (DC), in collaboration with Tourism Economics, a subsidiary of Oxford Economics, has crafted a revised Tourism Outlook extending to 2030.

The Fall 2023 Tourism Outlook was conducted between June and September 2023, and the outlook’s assumptions reflect the operating context of that time.

This Tourism Outlook presents the current state and future of tourism in Canada with special attention to the opportunity gap that exists and how to mobilize industry and partners to address barriers to growth and unlock the full potential of Canada's tourism sector.

Unless otherwise specified, all financial values are expressed in current (nominal) CAD.

Skift Global Forum 2023: 10 Takeaways for the Future of Hospitality and Travel

For this report, Skift partnered with Accor to provide an overview of some of the most important conversations and insights shared by industry leaders at this year’s event. In the sections that follow, topics are explored across aviation, hospitality, destination marketing, online booking, and more, through executive interviews, deep-dive panels, and Skift research.

Questions addressed in this report:

How are travel’s most creative leaders staying ahead of consumers? Who will win in an increasingly competitive booking ecosystem? How is tourism evolving to balance growth and sustainable practices? Can tech finally streamline a multifaceted experiences ecosystem? What are brands doing to operationalize sustainable travel and make it enticing? What are the macroeconomic trends and signals that will impact travel’s future?

Ontario Tourism Health Check - as of May 31, 2023

Destination Ontario’s Data & Insights team has released the most recent Ontario Tourism Health Check report highlighting recovery indicators such as accommodation occupancy rates and border crossings. As a reminder, this report tells the tourism recovery story by curating relevant tourism data into a format that visualizes the information for industry stakeholders. The report is based on open-data and is shareable with the Ontario tourism industry.

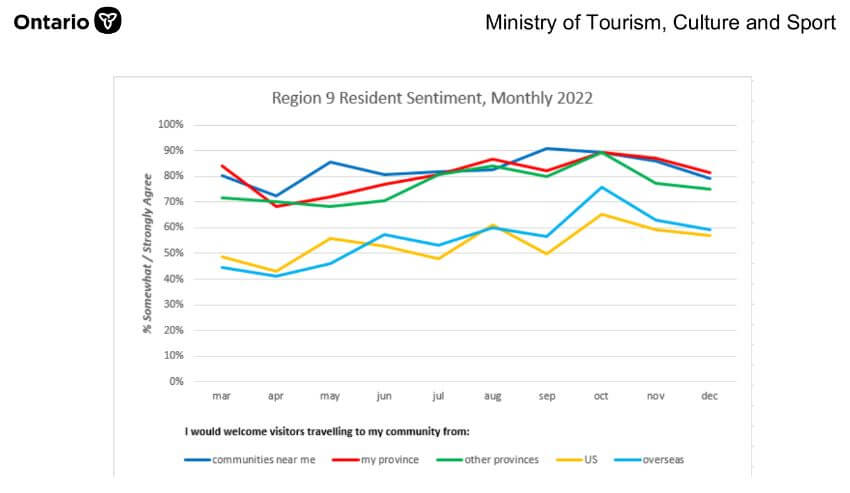

Resident Sentiment by Region 2022

The Destination Canada Monthly COVID-19 report from the Ministry of Tourism, Culture and Sport, reflects resident sentiment to welcome visitors to the region of RTO9. You can read the full report here.

Federal Tourism Growth Strategy

In a widespread effort to build back better and more inclusively, this Strategy recognizes the important role that the visitor economy has to play in advancing progress for equity-seeking and marginalized groups towards a more modern Canada. As such, there are key guiding principles and foundations that underpin the development of this Strategy.

State of the Ontario Tourism Industry Report

Tourism Industry Association of Ontario (TIAO) published its Ontario Tourism Industry Report (December 13, 2022) covering four major areas: economy, labour, infrastructure, and the future of tourism in Ontario. The report discusses various challenges facing the tourism industry in Ontario, including labor shortages, economic instability, bureaucratic obstacles, housing and transportation difficulties, and a lack of investment and development opportunities. It also emphasizes the importance of sustainability and innovation in driving future growth in the industry. Despite ongoing challenges related to the COVID-19 pandemic, the report remains optimistic about the future of tourism in Ontario and calls for continued collaboration between industry and government partners to achieve this goal.

Tourism Significantly Drives the Economic Growth of Destinations

The tourism sector plays a significant role in improving the livelihoods of people around the world. For the past nine years, the sector has grown at a faster rate than the global economy, resulting in a greater enhancement of people's livelihoods and their communities than most other industries. In fact, the growth of the sector’s GDP per capita outpaced that of the overall economy between 2011 and 2019, with an average annual growth rate of 2.9% compared to 1.7%. This was true for all key regions. Southeast Asia recorded the highest annual growth rate in tourism at 6.7% compared to 3.7% for the overall economy; while the Middle East achieved a 3% growth in tourism compared to 0.3% for the overall economy of the region.

Tourism’s Big Shift: Key Trends Shaping the Future of Canada’s Tourism Industry,

Destination Canada released a new report, Tourism’s Big Shift: Key Trends Shaping the Future of Canada’s Tourism Industry, identifying the key macro, industry, and market trends that will have the greatest impact on Canadian tourism in the coming years, such as accelerated digitalization, labour and skills shortage, and remote work and residential tourism. In January 2022, DC will be hosting industry webinars to delve deeper into the key trends that will impact Canada’s tourism sector and explore the implications for tourism businesses and operators across the country. Details to come soon.

Destination Ontario 2022 Travel Intentions September 16

To understand Ontarians’ anticipated travel patterns in the next 12 months

• Measure interest in and the incidence of vacationing within Ontario vs. outside Ontario in the next 12 months

• Assess the opportunities for targeting those planning to travel within Ontario and outside Ontario

• Further drill down to understand the consumer segments that are planning to travel within Ontario and are willing to spend on revenue-generating activities

• Determine what types of vacations and activities these segments are interested in so that Destination Ontario can match its products to the segments

• Better understand who the low-priority targets are and how to overcome barriers to Ontario travel

Destination Ontario 2022 Travel Intentions June 16

Ontario tourism is in the recovery phase. Travellers are more willing to travel and to participate in tourism activities than they were in 2021. More people are willing to travel in the next 12 months than in 2021 when the COVID pandemic travel restrictions were imposed on Ontario.

This Travel Intentions and Motivations Study was commissioned by Destination Canada and was prepared by Forum Research.

State of Tourism in Canada During COVID 19

The ‘State of Tourism in Canada during COVID-19’ dashboard is compiled by Twenty31 analysts to provide a weekly snapshot of recent global, regional and domestic tourism health and economic, and insights on the impact of COVID-19 on the travel and tourism industry’s path to recovery. Insights are derived from a review of myriad global and Canadian media sources, associations, consultancies, and expert opinion from the tourism industry and government. We analyze the current state and future potential of key drivers of tourism recovery, including the most important tourism channels – tour operators, OTAs, airlines, tourism businesses, travellers, and source markets.

January 2019 - State of Tourism

In 2016, 7.8 million visitors spent $817 million in the region, the total tourism employment impact was 7,078 jobs and there were 6,645 tourism-related businesses in operation.

This document offers a summary of the performance of the tourism industry for the years 2016 through 2018; it includes trends over the previous years and other analyses on the key indicators that offer market intelligence and insights about the state of the industry.